Featured Post

Auto Industry Ebitda Multiples

- Get link

- X

- Other Apps

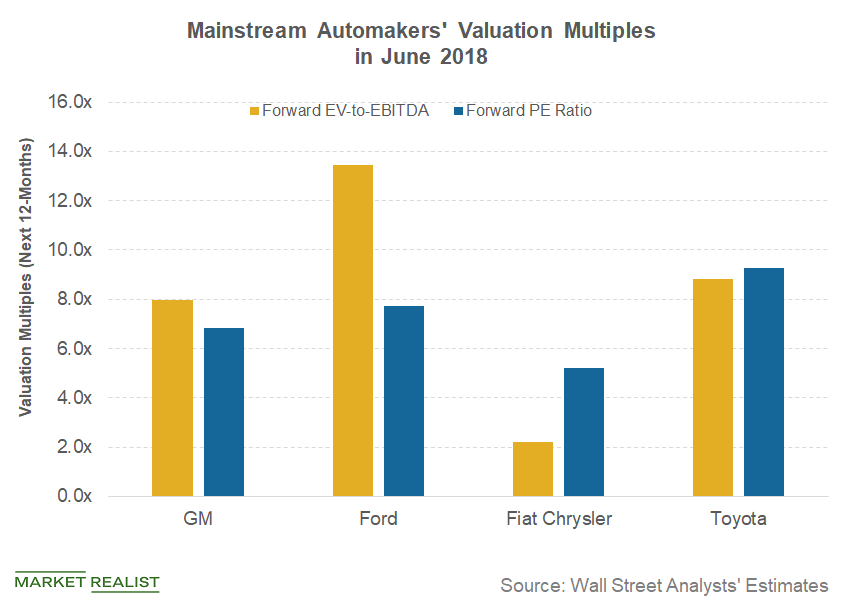

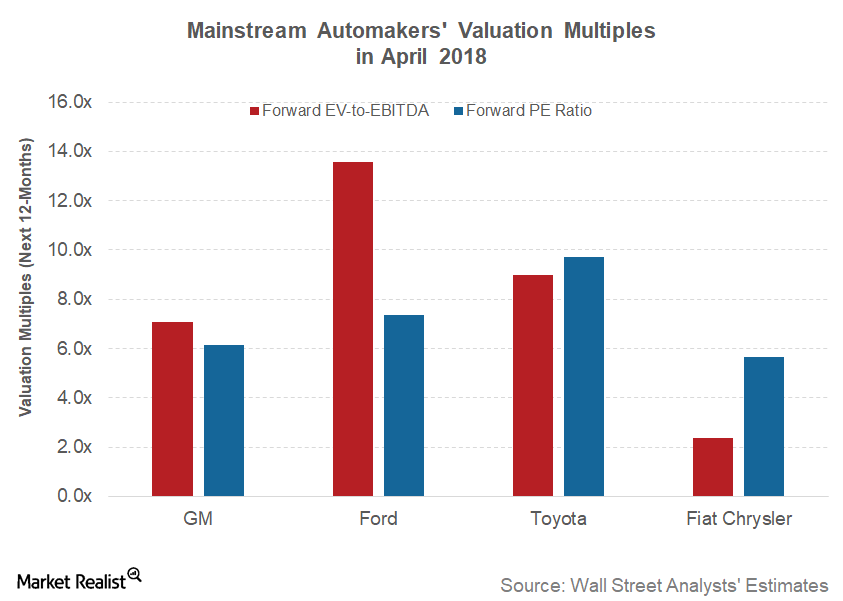

221 rows Industry. Among the auto industry players were focusing on Fiat Chrysler has the lowest EV-to-EBITDA and PE multiples of 24x and 57x respectively.

United States Ev Ebitda Technology And Telecommunications 2020 Statista

To evaluate the estimate of the value of the business one can use financial ratios such as.

Auto industry ebitda multiples. EBITDA multiples are declining. Here is our short list of the typical valuation multiples for private businesses. We provide enterprise value multiples based on trailing Revenue EBITDA EBIT Total Assets and Tangible Assets data as reported.

This represents 52 growth year-over-year. The numbers suggest that there are no shortcuts to higher valuation. The multiples on the table above are trailing twelve months meaning the last four quarters are used when earnings before interest taxes depreciation and amortization are calculated.

Similarly FCAUs forward PE multiple was at 63x the lowest in its peer group. Share prices declined very slightly on average across the quarter less than 1 with the strongest performing sub-sectors being Automotive Sales 10 and Aftermarket 12. 221 rows Multiples reflect the average price of a company when compared to a value driver in this case.

While EBITDA multiples across all industries were highest over a five-year period in the third quarter of 2017 at 47x in the second quarter of 2018 these multiples plummeted to 28xthe lowest level over the same five-year period. The EBITDA multiple is a financial ratio that compares a companys Enterprise Value Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest to its annual EBITDA EBITDA EBITDA or Earnings Before Interest Tax Depreciation Amortization is a companys profits before any of these net. Advanced Medical Equipment.

At the outset of 2018 analyst estimates pegged the auto industry to suffer a downturn in the US. Industry specific multiples are the techniques that demonstrate what business is worth. The product inventory may be factored out of the multiplication and added on top to come up with the enterprise value of the business.

The fundamental rationale behind multiples-based valuation is that businesses in the same industry or sector should be valued based on their comparison to other similar businesses. EV to EBIT and EBITDA earnings before interest taxes depreciation and amortization. Industry trends Automotive industry trends Vehicle production continues to remain strongAccording to IHS Automotive global vehicle production exceeded 170 million units in calendar year 2014 and 43 million units in Q4 compared to the 40 million units in Q4 2013.

Enterprise value EV to gross revenues or net sales. Enterprise value EV divided by revenues net sales EV to EBITDA. Business value to EBIT and EBITDA.

How to calculate multiples. The EBITDA stated is for the most recent 12-month period. EBITDA Multiples by Industry Nevertheless when valuing a business it is essential to consider the effect on EBITDA multiples of the industry in which the business operates For most businesses with EBITDA of 1000000 - 10000000 the EBITDA multiple will be in the general range of 40x to 65x increasing as EBITDA increases.

The multiples are ratios that let you calculate what is known as the enterprise value of a company based on the selling prices and financial performance of similar firms. Value to sellers discretionary cash flow SDCF or SDE. EVMultiple Max Rev EBITDA EBIT TotAss TanAss HotelsMotels7011 28 285 1135 2012 111 124 Services-PersonalServices7200 12 245 1081 1402 141 179.

Company value to total business assets or owners equity. 29 rows Only positive EBITDA firms. The EBITDA multiple for a specific sector is calculated by dividing the total enterprise value of all sector companies by the total sum of annual EBITDA of the companies.

Industry Valuation Multiples The table below provides a summary of median industry enterprise value EV valuation multiples as at the Report Date. In the auto sector Fiat Chrysler has the lowest EV-to-EBITDA multiple of 22x. Enterprise value EV divided by revenues net sales EV to EBITDA.

Enterprise value EV to gross revenues or net sales. The valuation multiples commonly used for valuation of auto dealerships are these. This is higher than other companies within the Consumer Durables industry meaning investors expect Apple to grow faster than its peers.

Auto market defied expectations notching 2018 as the fourth consecutive year with over 17 million vehicles sold. EV to net income. The valuation multiples commonly used for valuation of auto dealerships are these.

3 For a company to realize the industry-average multiple it must match the. Whats more multiples are highly variable within industries themselves reflecting the differing growth rates and profitability of different parts of the economy Exhibit 2. Valuation of an auto dealership business.

1226 959B 782B. Chinese sales met the negative outlook with light vehicle sales declining 17 in 20181 However the US. Multiple of more than 15 times EVEBITDA Exhibit 1.

Over 12 times EBITDA per share to be exact. Valuation Multiples by Industry. The data is grouped by industry SIC code.

Trading multiples had a mixed performance in the quarter. Apples EBITDA multiple of 1226 means investors are willing to pay a premium to buy shares of the company. EV to net income.

For example a business with an EBITDA of 10 million with comparable EBITDA multiples of between 6 and 8 times would likely be valued between 60 million and 80. The table below summarises eVals current month-end calculations of trailing industry enterprise value EV multiples for US listed firms based on trailing 12-month financial data. Index indicating the enterprise value EV multiples against earnings before income tax and depreciation and amortization EBITDA In this analysis we determine EV as the total of market capitalization and interest-bearing liabilities.

The companys higher leverage. Figure 3 provides quarter-on-quarter multiples for a variety of automotive sub-sectors.

Global Ev Ebitda Metals Electronics 2021 Statista

Global Ev Ebitda Chemicals And Resources 2021 Statista

Comparing The Auto Industry S Valuation Multiples

Selling Your Business What You Need To Know What Is The Business Sales Process What Can You Expect Fro In 2020 Things To Sell Sell Your Business Sales Process

Dairy Farm Valuation Model Template Efinancialmodels Cash Flow Statement Grow Financial Enterprise Value

United States Ev Ebitda Energy Environmental Services 2021 Statista

Ebitda Multiples By Industry Chart Business Analysis Valuing A Business Selling A Business

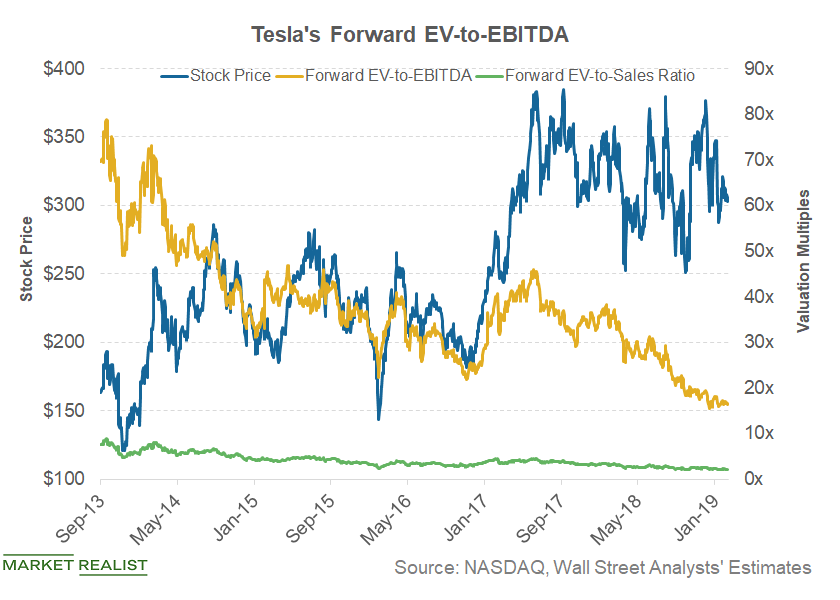

Analyzing The Trends In Tesla S Valuation Multiples In Q1

Agency Valuations The Truth About Ebitda Multiples Accounting Basics Business Analysis Income Statement

North American Industry Market Multiples

Serviced Office Financial Model Template Efinancialmodels Cash Flow Statement Excel Spreadsheets Templates Project Finance

Emerging Markets Ev Ebitda Consumer Goods Fmcg 2021 Statista

The Changing Geography Of The American Auto Industry Area Development Automobile Industry American Auto Auto

Market Check Ev Ebitda Multiple Trends By Sector Kpmg Japan

Valueadd Global Ma Periodical August 2020 Business Strategy Finance Investing Quantitative Research

Global Ev Ebitda Transportation Logistics 2021 Statista

Comparing Auto Industry Valuation Multiples

Multiples The Market Approach To Valuation Chinook Capital

The Us Listed Beigene Bgne Us Aims To List In Hong Kongby Raisingusd1 Billionvia Issuing Newshares The Company Plans To U Financial Analysis List How To Plan

Comments

Post a Comment