Featured Post

What Is Solvency Ratio In Insurance Industry

- Get link

- X

- Other Apps

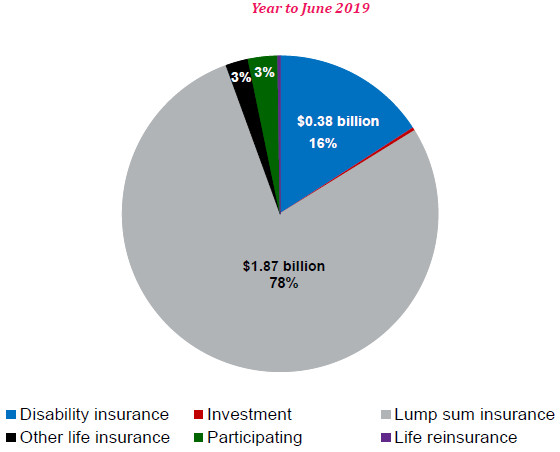

On the flipside a combined ratio of more than 100 represents an underwriting loss which means an insurer is reliant on investment income to square the ledger. How much risk an insurer is taking on and underwriting for whether they have enough collateral and reserve cash to pay claims upfront whether they have the invested funds to pay future claims if.

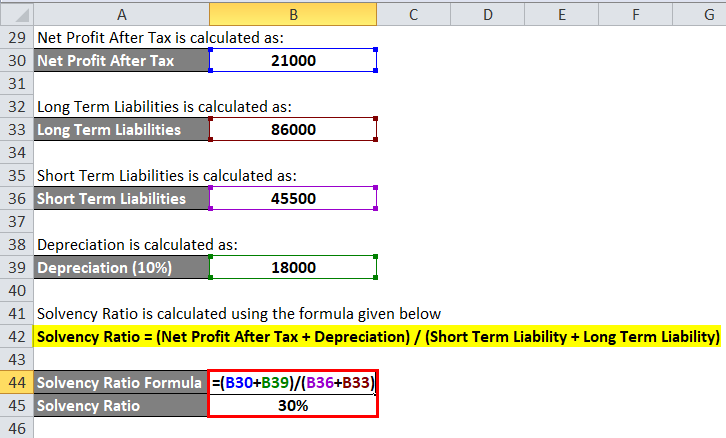

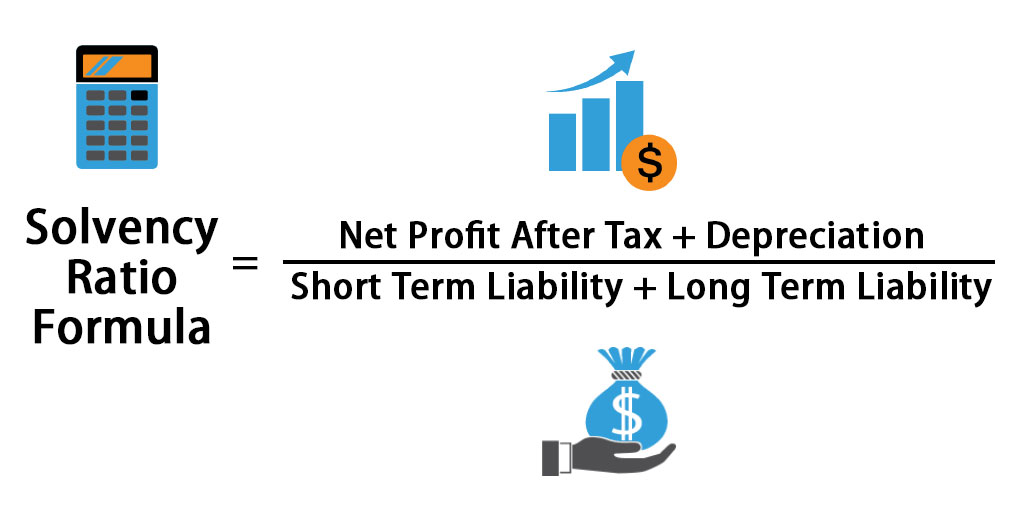

Solvency Ratio Formula Calculator Excel Template

The lower the positive ratio is the more solvent the business.

What is solvency ratio in insurance industry. The solvency ratio of an insurance company is the size of its capital relative to all the risk it has taken which is all liabilities subtracted from total assets. Therefore by reviewing the solvency ratio of a potential insurer you can raise the likelihood of your claims being settled even before you purchase the life insurance policy. A life insurance company with a high solvency ratio is more likely to be financially stable more equipped to pay out insurance claims and able to survive for long time.

The indicator reflects the ability of an insurance company to meet its obligations to beneficiaries and policy holders. As compare to debt-heavy industries like utilities the solvency ratio result of the technology industries is higher. The solvency ratio of an insurance company is the size of its capital relative to premium written.

The United Kingdom UK which. As per the guidelines by the IRDAI only Life Insurance corporation of India has to maintain the solvency ratio nearly 150. Determining an insurance carriers solvency ratio includes.

According to Irdai guidelines all companies are required to maintain a solvency ratio of 150 to minimise bankruptcy risk. The debt to equity ratio also provides information on the capital structure of a business the extent to which a firms capital is financed through debt. The solvency ratio of an insurance company is the size of its capital relative to all the risk it has taken which is all liabilities subtracted from total assets.

The term solvency ratio refers to the liquidity ratio that measures the ability of a company to pay off its entire liabilities by using the internal cash accrual generated from the business. Insurance companies in India. In the insurance industry the Solvency ratio is an expression of efficient capital management.

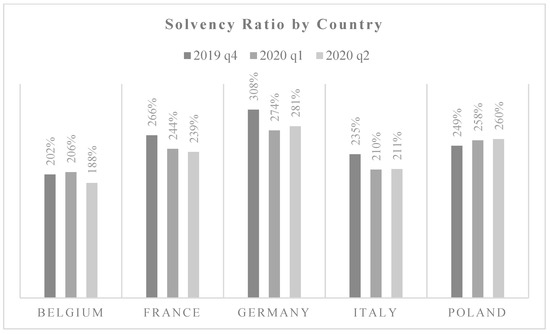

As of the end of 2019 the German insurance industry had Solvency Capital Requirement SCR ratio of 310 percent. But more importantly will the impact be so significant that it threatens the very existence of certain insurance companies themselves. Companies also strive to improve sales in order to improve solvency and profitability.

This ratio is relevant for all industries. The solvency ratio is a measure of the risk an insurer faces of claims that it cannot absorb. What is Solvency Ratio.

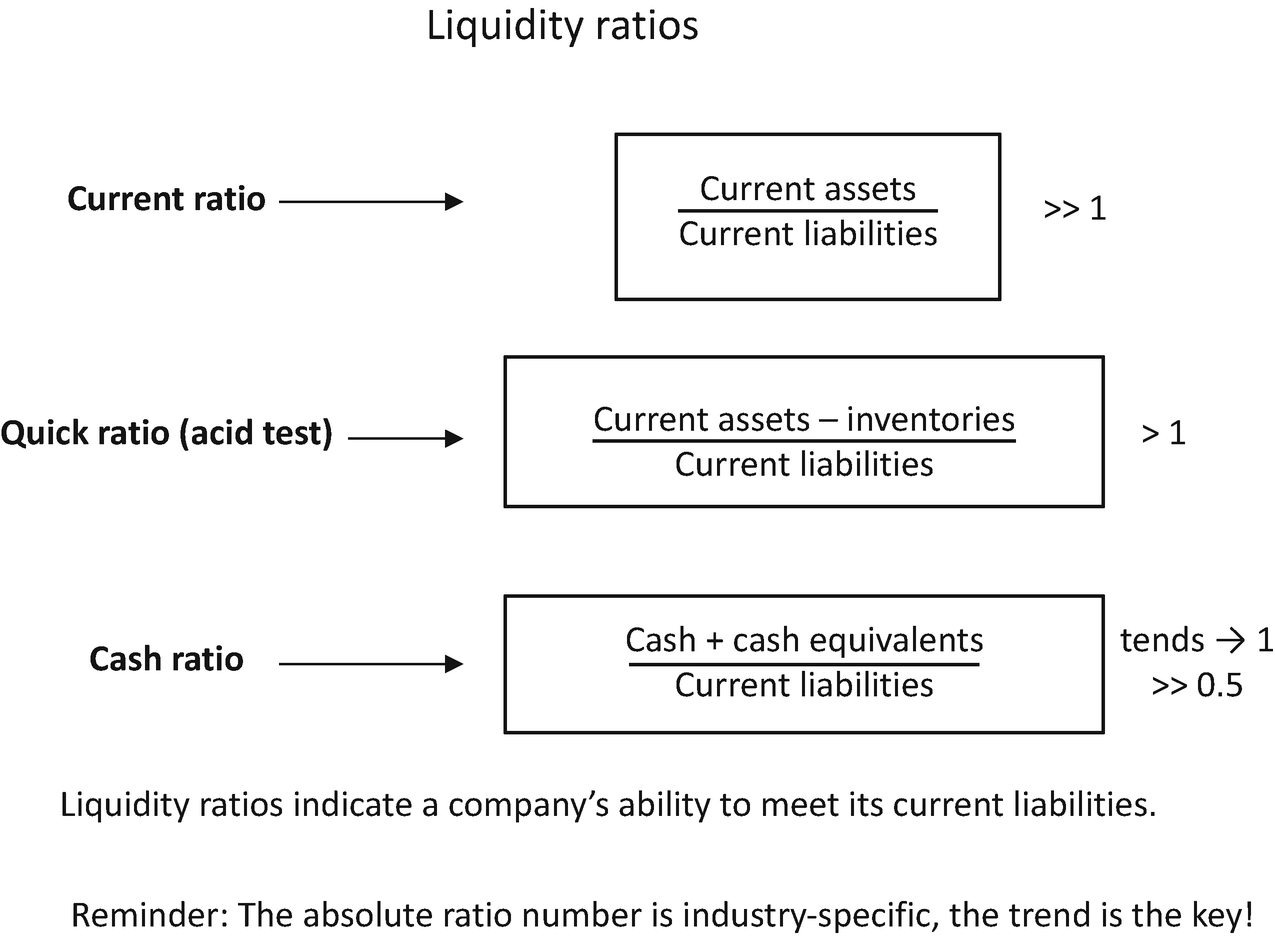

Net assets net premium written. Solvency analysis Solvency ratio is the ability of a company to meet its long-term fixed expenses and to accomplish long-term expansion and growth. In other wordssolvency is a measurement of how much the company has in assets versus how much it owes.

22 rows Financial ratio Year. Solvency ratio It defines how good or bad an insurance companys financial situation is on defined solvency norms. Solvency Ratio a statutory ratio test which is usually net written premiums divided bycapital and surplus.

A combined ratio below 100 means an insurance company is operating at an underwriting profit a profit before adding the returns from investing customers premiums. This is a solvency ratio which indicates a firms ability to pay its long-term debts. A solvency ratio of greater than 20 is considered financially healthy.

2020 2019 2018 2017 2016 2015. In other words solvency is a measurement of how much the company has in assets versus how much it owes. A commission established in 1988 to develop a risk-based standard for theamount of capital held by banks.

The solvency ratio is most often defined as. Solvency ratios are also known as leverage ratios. It is a basic measure of how financially sound an insurer is and its ability.

All insurance companies are required to comply with. Basel Committee on Banking Supervision. Hence an insurers solvency ratio is a direct indication of its ability to pay out claims.

Solvency Margin for insurance companies is akin to apital Adequacy Ratio of anks. Solvency ratios are a key component of the financial analysis which helps in determining whether a company has sufficient cash flow to manage the debt obligations that are due. The original formula calls for banks to hold 8percent of capital against.

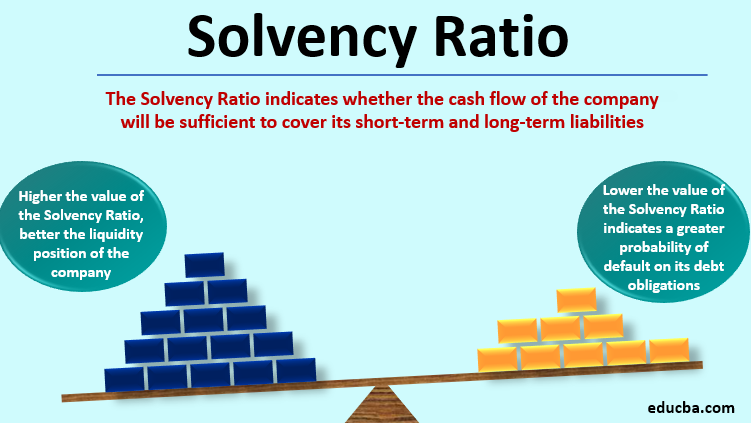

Wikipedia says that a solvency ratio measures the extent to which assets cover commitments for future payments the liabilities 2What everyone wants to know is - how will COVID-19 and the related financial markets impacts affect the insurers solvency positions. In the long term most of the companies take the step to improve the solvency ratio results in order to increase profitability. In other words the solvency ratio indicates whether the cash flow of the company will be sufficient to cover its short-term and long-term liabilities or whether it will default.

The higher the ratio the better equipped a company is to pay off its debts and survive in the long term. Ratio Formula Significance in Analysis Solvency Margin As reported to IRDA Adequacy of solvency margin forms the basic foundation for meeting policyholder obligations.

Spanish Insurance Market Analysis Of Scr Own Funds And Solvency Ratios 2020 Revista Del Servicio De Estudios Mapfre

A Financial Health Check Of State Run Insurers To Be Listed

Solvency Vs Liquidity Online Accounting

What Is The Best Solvency Ratio

E U Solvency Ii Ratios June 2016 Global Benefits Vision

What Is The Best Solvency Ratio

Spanish Insurance Market Analysis Of Scr Own Funds And Solvency Ratios 2020 Revista Del Servicio De Estudios Mapfre

Statistics By Solvency Ratio Download Table

Why Solvency Ratio Is Important Indicator Of Life Insurance Companies Abc Of Money

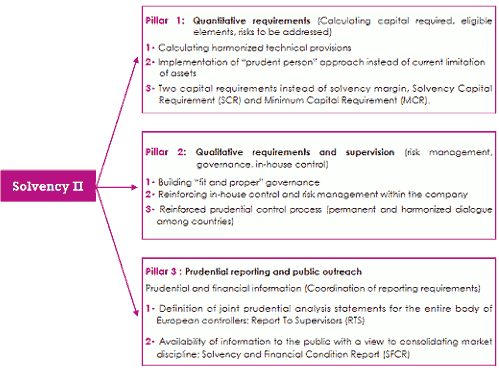

Risk Appetite In The Insurance Industry And The Solvency Ii Approach

Scr Ratio In Europe By Country 2020 Statista

Spanish Insurance Market Analysis Of Scr Own Funds And Solvency Ratios 2020 Revista Del Servicio De Estudios Mapfre

Spanish Insurance Market Analysis Of Scr Own Funds And Solvency Ratios 2020 Revista Del Servicio De Estudios Mapfre

Solvency Margin Insurance Companies Insurance Sector

What Are The Types Of Solvency Ratio

Jrfm Free Full Text Financial Stability Of European Insurance Companies During The Covid 19 Pandemic Html

Spanish Insurance Market Analysis Of Scr Own Funds And Solvency Ratios 2020 Revista Del Servicio De Estudios Mapfre

Spanish Insurance Market Analysis Of Scr Own Funds And Solvency Ratios 2020 Revista Del Servicio De Estudios Mapfre

Comments

Post a Comment